RIM has just announced its earnings for Q3 2013 (the three months ending December 1, 2012 in non-RIM terms), including a five percent drop in revenue to $2.7 billion and an adjusted net loss of $114 million. GAAP net income from "continuing operations" was $14 million, though, or $9 million when taking into account the loss from discontinued operations, and it's also reporting a cash increase of about $600 million to $2.9 billion. In terms of devices, RIM says it shipped 6.9 million smartphones and 255,000 PlayBooks during the quarter, although it's again only talking in terms of devices "shipped," not actual sales to consumers. Along with the earnings, the company has also announced that its CIO, Robin Bienfait, has decided to retire, although RIM says she will stay on in an "advisory capacity to enable a smooth launch and seamless transition."

As for BlackBerry 10, CEO Thorsten Heins unsurprisingly reiterated that the company is all set for the January 30th launch date, and noted that more than 150 now completing technical acceptance programs for the first BlackBerry 10 products. The company also says it will be "significantly increasing its marketing spending this quarter" to support the launch of BB10, which it warns will contribute to a loss for the fourth quarter, as will the likely slowdown of BlackBerry 7 product sales as consumers hold off for BB10.

Update: During the company's earnings call, Heins confirmed that RIM's global subscriber base now stands at 79 million worldwide, which is a slight decline from the previous quarter but still an increase year-over-year. Not surprisingly, he says the biggest losses came from North America. RIM also confirmed on the call that its BlackBerry sell-through for the quarter was 8.4 million, or actually higher than the number of new devices shipped.

Continue reading RIM's Q3 2013 earnings: $2.7 billion revenue, $114 million adjusted net loss, CIO to retire

Filed under: Mobile, RIM

Comments

Source: RIM

You know it's bad when your mobile business gets trounced by the rival that sold a smartphone that actually blew up in its customers pockets. That's the situation over at LG, whose mobile communications division contrived to lose $389.4 million acros...

You know it's bad when your mobile business gets trounced by the rival that sold a smartphone that actually blew up in its customers pockets. That's the situation over at LG, whose mobile communications division contrived to lose $389.4 million acros...

You know it's bad when your mobile business gets trounced by the rival that sold a smartphone that actually blew up in its customers pockets. That's the situation over at LG, whose mobile communications division contrived to lose $389.4 million acros...

You know it's bad when your mobile business gets trounced by the rival that sold a smartphone that actually blew up in its customers pockets. That's the situation over at LG, whose mobile communications division contrived to lose $389.4 million acros...

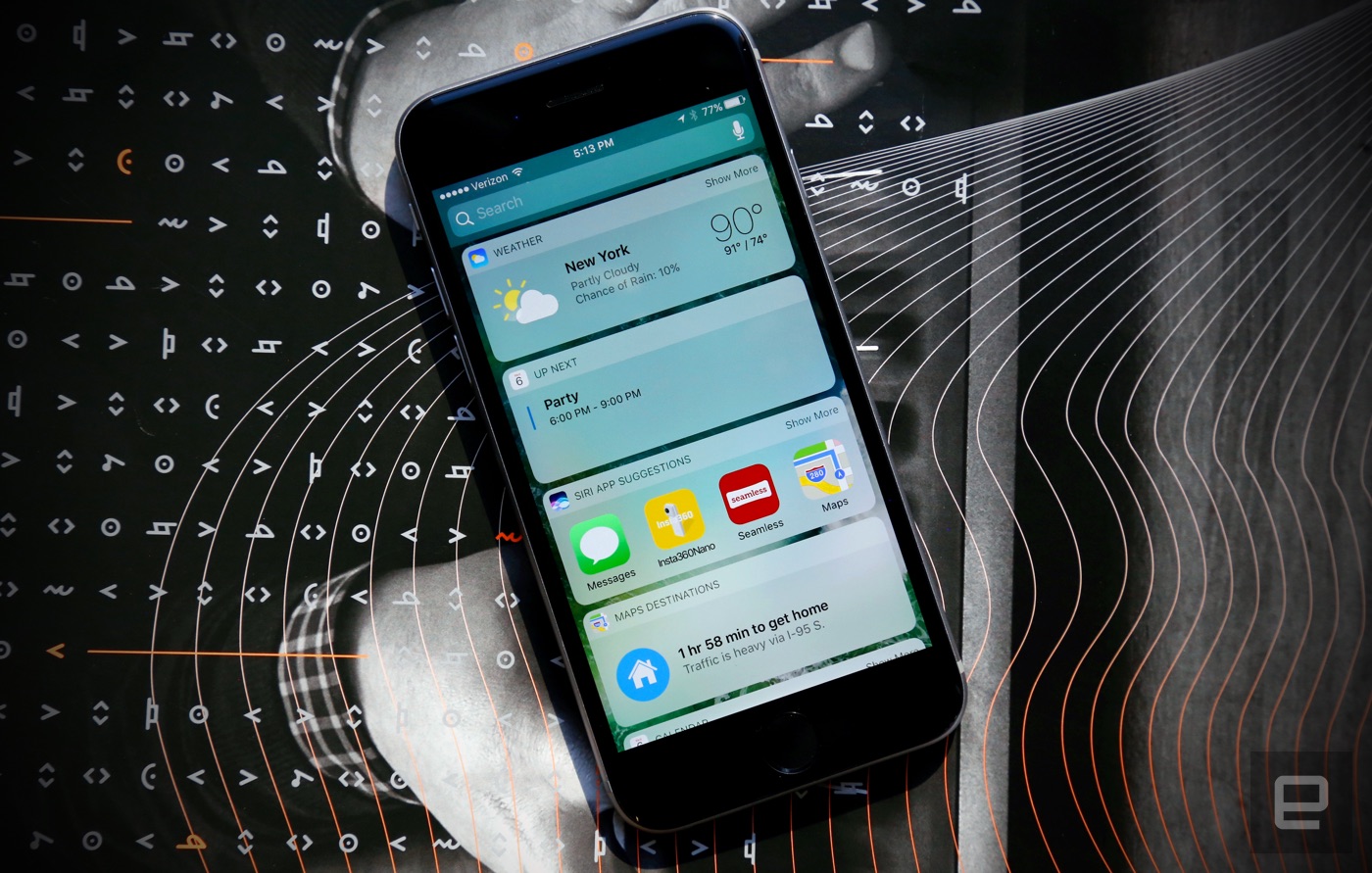

After seeing Apple struggle through 2016, Wall Street set its sights pretty low for the company's Q3 earnings report. Those financial results just dropped, and while they're still not amazing for the folks in Cupertino, Apple did well enough to allay...

After seeing Apple struggle through 2016, Wall Street set its sights pretty low for the company's Q3 earnings report. Those financial results just dropped, and while they're still not amazing for the folks in Cupertino, Apple did well enough to allay...